The Klinger volume indicator is a very useful and powerful indicator of technical analysis. Trend = +1 if (H + L + C) > ( H + L + C) What does the Klinger volume indicator tell traders? The trend calculation has the following formula.

Where V and T represent volume and trend respectively. We can calculate the volume force by using the following formula. The first step involves the calculation of the volume oscillator by subtracting the 34-period exponential moving average of the volume force from the 55-period exponential moving average of the volume force. However, we are going to share the basics of the calculations and the Klinger volume indicator’s formula.

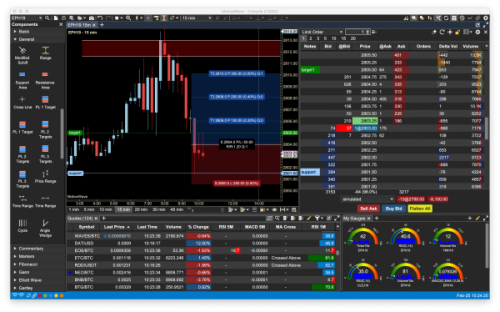

MOTIVEWAVE VOLUME IMPRINT HOW TO

Instead, they need to fully understand how to interpret the indicator. The calculations and the Klinger volume indicator’s formula is complex and traders do not need to comprehend it. Calculations and the Klinger volume indicator’s formula The indicator revolves around the concept that how volume is flowing through an asset and how the short-term and long-term prices are affected by it. The 13-periods moving average is the by default signal line that helps to identify times to buy or sell. The red line represents Klinger while the blue line is the signal line. It consists of two lines, usually red and blue in color, fluctuating above and below the zero line.

This volume force then turns into an oscillator by getting a fast exponential moving average of the volume force and subtracting from it a slow exponential moving average of the volume force. It employs high, low, close, and volume to generate a volume force.

Klinger developed the Klinger volume oscillator.

0 kommentar(er)

0 kommentar(er)